Figuring out how to save money every month can greatly boost your financial security. The most difficult part is knowing how and when to start. Saving becomes a habit rather than a chore if you’ve discovered money-saving strategies and techniques that work for you.

Setting a monthly goal can help you maintain the consistency needed to create a decent savings account over time. Continue reading to learn the best tips to save money each month so you can start improving your financial situation right away.

Establish Your Budget

The easiest way to get started with budgeting is to become aware of your spending habits. Get a receipt for everything you buy throughout the month. On the first day of a new month, organize your receipts by categories, such as dining, groceries, or personal care.

By doing this, you’ll be able to see exactly where your money goes every month. This may also be available as an online banking feature through your bank or credit union. It can be humbling to see how much you spend on food, shopping, and other expenses in total.

After this exercise, calculate your monthly income, choose a budgeting plan, and track your progress. As a simple budgeting system, use the 50/30/20 rule. Allow up to 50 percent of your income for necessities, 30 percent for things you want, and 20 percent for savings and reducing debt.

Set Up Automatic Savings

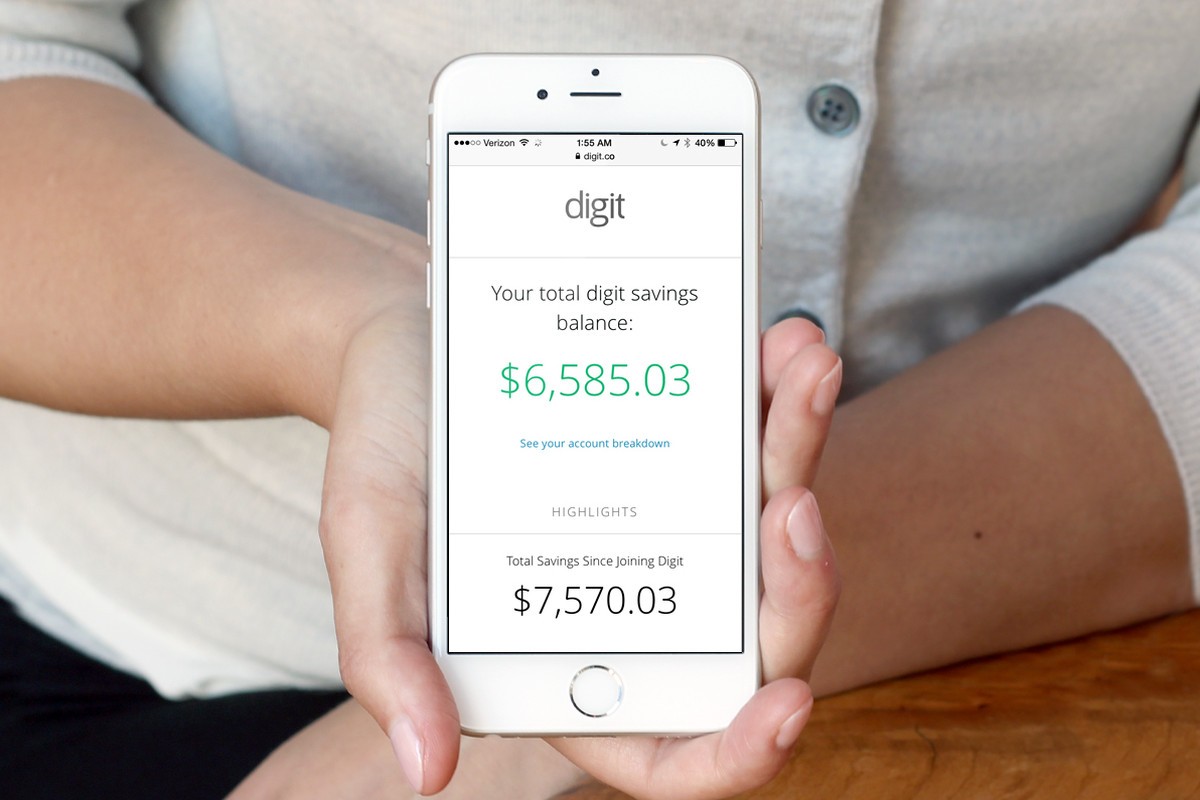

Consider automating your savings. The simplest and most successful approach to saving is to set up automatic savings, which keeps extra cash out of sight and out of mind. Automatic savings refers to a system in place to save money at predetermined periods, such as monthly, weekly, or daily.

You can set up an automated savings plan to have a percentage of your paycheck deposited into a bank account regularly. This type of savings plan is ideal for those who want to build up their savings over time without physically depositing earnings every few weeks.

To get started, connect your savings and checking accounts, arrange for a direct deposit from your company to go into your checking account, and then set up an automatic payment from the checking account into the savings account.

Set a Short-Term Savings Goal

Setting a short-term target helps people save more effectively. For example, committing to saving $20 each week or month for six months is much more feasible than committing to saving $500 per month for a year.

You can also leave yourself a reminder on your debit or credit card. Cover your card with a savings reminder like “Have you hit your savings target for the month?” Write the note on a piece of adhesive tape or vibrant washi tape to remind yourself to carefully think through every transaction.

With this small step, you have set a saving practice to be proud of when you meet your short-term goal! With a new goal, you’ll be able to keep it up in the long run.

Use the 24-Hour Rule

It’s hard not to be enticed by the incredible deals available when shopping online. It’s all too easy to make a hasty purchase and squander money that should be saved.

The best tip to avoid online shopping temptation is to avoid making quick purchases. Put an item in your online shopping cart temporarily, and make a 24-hour rule for all non-essential purchases, such as the latest gadget or new clothing.

While you might still buy the items after 24-hours, you might also come back and discover you didn’t actually need it all!

Play Your Cards Right

To avoid falling into debt or wasting hundreds of dollars in interest and fees, using a credit card involves careful spending and budgeting. However, if you purchase carefully and use your credit card wisely, you can save or even earn money by taking advantage of incentives, points, and other perks.

A credit card can be an advantage and you can avoid going into debt if you follow two simple rules. The first is to just charge to the card what you can afford and the second is to pay off the total amount of your bill each month.

Small regular purchases using your card can build up substantial savings over time if you play your cards well. Put as many of your everyday purchases—groceries, restaurants, gas, utilities, and anything else you can think of—as possible on a credit card that offers big cashback rewards.

Remember to pay off your credit card bill in full at the end of the month, though. If you just pay interest on a balance, you’ll lose whatever perks you’ve earned and probably end up with additional charges.

Switch or Reduce Your Home Telecom Service

Cable TV, Internet, and landline services are provided by multiple companies in most areas. There is sometimes a significant price variation between them. Don’t be afraid to transfer providers or threaten to leave your present one. By doing this you might get some deals that aren’t shown on the website.

For decent savings, you might consider canceling your landline or TV service. Dropping cable or satellite TV can save you a lot of money, especially now with the prevalence of web-based cable-substitute services like YouTube TV and Hulu with Live TV have emerged.

You may completely avoid paying for television by investing $40 or so in a new antenna that enables you to get clear over-the-air digital broadcasts of the biggest networks, as well as a variety of alternative programming. Switching or reducing your home telecom service could save you more than $40 per month.

Get Discounts on Entertainment

When going out to enjoy activities in your city, schedule your visit with intention. Some zoos, parks, theaters, galleries, and museums offer special deals like standing-room-only or pay-what-you-can nights. On some days of the month, some even provide free entry.

In addition, Mother Nature provides lots of free and inexpensive amusement. Hiking, fishing, kayaking, picnicking, bird watching, and camping are all fun things to do. Moreover, state and national parks are affordable and provide a stunning backdrop.

Finally, pursuing a new pastime or passion will keep you occupied for months, if not years. Joining a team or taking a course through a private business can be costly. Alternatively, save money by enrolling in an art class, learning a foreign language, or joining a sports team through your local recreation department or community college.

Pack Your Lunch

Though it may be tempting to rush out of the office at midday to pick up a sandwich or salad from the corner store, preparing your own lunch may save you hundreds or thousands of dollars per year if done right.

While preparing homemade lunches shouldn’t take up a large portion of your day, you will need to set aside some time each week to prepare your meals for the coming days. Set aside an hour each week to prepare larger batches of basic ingredients like roasted veggies, cooked chicken breasts, etc.

Once you’ve gotten into the habit of packing nutritious, filling work lunches on a daily basis, take your money-saving skills to the next level by learning to master discounts and coupons. Stay updated on the best pricing on essential ingredients you use during the week and month using your favorite coupon applications.

Buy in Bulk

When products are purchased in bulk, they are less expensive. Buying in bulk is always the first step toward saving money on your grocery bill. Make a list of the items you frequently purchase and see which ones you can afford to buy in bulk.

Become a member of a warehouse club such as Costco or Sam’s Club. There is a membership fee, but the products are cheaper than those normally offered in grocery stores. Furthermore, these warehouse clubs frequently provide promotional items and freebies to their customers.

Consider getting the largest available size for the products if you don’t have the budget to buy in bulk or if you don’t want to stock on a specific product. Bigger sizes might imply more expensive packaging, and some products are not less expensive due to their size. Divide the item’s price by its weight or volume to find which is the cheapest per-unit basis.

Conclusion

It’s amazing how minor changes to your budget can result in major savings. It’s much easier to save money each month if you change your money habits and minimize spending with the tips above and wherever possible.

You may feel that your small expenses aren’t adding up, but it’s amazing how much money you end up spending on things like your daily caffeine fix in the long term. Financial success is around the corner!