I have always been looking for how simple, and smart banking can make my life easier. I wanted to entrust my finances to a banking institution that I could trust while valuing my lifestyle. Cashplus Bank did it for me.

Cashplus Bank offers smart banking services to over 1.6 million customers in the United Kingdom. Cashplus Bank also provides banking experiences that cover the needs of its customers, including prepaid cards and credit cards.

The Cashplus Bank Credit Card is designed to give its holders control over their money and spending. Discover the features and benefits of the Cashplus Bank Credit Card and Learn how to apply for a Cashplus Bank Credit Card online in this article.

Cashplus Bank Credit Card Features

Cashplus Bank proved its caliber as a banking institution in just a short period by offering an innovative and seamless banking experience to its customers. It introduced the first prepaid card in the country. Before it became an official bank, it offered a current account to customers, also a first in the UK.

It now claims that it is a bank that has created the best account for its customers’ needs. Cashplus Bank caters to whatever lifestyle and plans their customer has. The bank has offers for those who would like to save for travel or even those who want to open a business.

One of the most popular products of Cashplus Bank is the Personal Credit Card. When I discovered the Cashplus Bank Credit Card, I immediately looked into its features. It promised that I could get the credit I deserved with the credit card.

What hooked my eye is that I only need to improve my credit rating so I can apply online for a Cashplus Bank Credit Card. After an instant online decision, I can enjoy the perks of the Cashplus Bank Credit Card.

Learn More About the Cashplus Bank Credit Card

It is important to know why a banking institution offers credit cards. In this way, I know what they value and what they can offer to their customers. I discovered that Cashplus Bank wants its customers to have a credit card that gives us control.

Cashplus Bank Credit Card paves a way to borrow money flexibly and affordably. Interestingly, Cashplus Bank is open for those currently looking for their first credit card and those who have had credit problems in the past.

The bank only wants Cashplus Bank Credit Card cardholders to stay within their credit limit and make at least the minimum monthly payment. If I abide by these requirements, Cashplus Bank promises that I can build a strong credit rating.

Pros of the Cashplus Bank Credit Card

Like any other credit card, the Cashplus Bank Credit Card offers numerous perks to help customers manage their finances easily. Cashplus Bank Credit Card is enticing because of its perks, as listed on Cashplus Bank’s official website.

First, I do not have to pay anything to get the Cashplus Bank Credit Card. It is all free as long as I qualify for the application. Aside from that, there is no annual or monthly fee for the credit card, so I can enjoy it as much as possible.

Cashplus Bank offers a 56-day interest-free perk for each billing period. If I am a good payer, I can enjoy 56 days of not having interest on my purchases using the Cashplus Bank Credit Card. As such, I try to pay everything on time to get almost two months of interest-free benefits.

Other Pros of the Cashplus Bank Credit Card

The credit card can also be used to make purchases in shops, online, or over the phone. Interestingly, I can use the Cashplus Bank Credit Card for almost all transactions without the worry of getting denied.

In addition, Cashplus Bank Credit Card is powered by Mastercard. So, it can be used for Mastercard contactless transactions, which are accepted in millions of locations worldwide.

It is also possible to withdraw cash from ATMs. Therefore, I do not need to panic whenever there is an emergency need for cash and I only have my Cashplus Bank Credit Card with me. Cashplus Bank allows its customers to withdraw cash through their credit cards.

Also read: Virgin Money All Round | How to Apply for the Credit Card

Repayment Options for the Cashplus Bank Credit Card

The Cashplus Bank Credit Card has proven its benefits and I can use it to borrow money for my purchases. Since the bank wants its customers to have a great banking experience, it offers flexible repayment options.

I appreciate that the bank values the capacity of its customers to pay for the borrowed money through the Cashplus Bank Credit Card. True to its tagline, the Cashplus Bank Credit Card is designed to give us control.

There are two options for how I can arrange the repayment scheme for my Cashplus Bank Credit Card. First, I can make manual repayments through the Cashplus Bank mobile banking app. To do this, I need to log in to my account and pay manually.

The second one is to set up a direct debit account for my Cashplus Bank Credit Card. It is ideal to have a direct drive as it protects me from forgetting to make a repayment. It will also help me avoid damaging my credit score and getting hit with a penalty fee.

Repayment Options Using a Direct Debit

Cashplus Bank informed me that it could arrange a direct debit for repayment when I applied for its credit card. There are four main options that I can work around to make the repayment options suitable for me.

I can either set up a minimum amount, fixed amount, fixed percentage, or full amount scheme for the repayment using my direct debit. For example, setting up a fixed amount is possible if the monthly purchase exceeds a certain amount.

Cashplus Bank allows me to change my direct debit repayment option scheme anytime.

Also read: Learn How to Order and Achieve a Low APR | Lloyds Bank Credit Card

Cashplus Bank Credit Card Fees

Perhaps the most important aspect of any credit card offering are the fees that accompany it. Here are the Cashplus Bank Credit Card fees.

- Annual Fee: £0

- Cash Advance: 3% (minimum of £3)

- Foreign Purchase Transaction Fee: 2.99% per transaction

- Foreign ATM Withdrawal: £3

- Regular Annual Percentage Rate: 39.9% variable

- Late Payment Fee: £12

- Over Limit Fee: £12

- Purchase Interest Rate: 2.84% (monthly) and 39.94% (annual)

- Cash Interest Rate: 3.43% (monthly) and 49.94% (annual)

Credit Limit of Cashplus Bank Credit Card

Upon applying for the Cashplus Bank Credit Card, they clarified the credit limit that I could get. The Cashplus Bank Credit Card has a minimum credit limit of £100 and a maximum credit limit of £3,000.

Cashplus Bank also mentioned that it reviews the credit limits of all its cardholders within the first six months. This is to see if it can offer me a higher credit limit based on my credit rating and credit card transactions, including purchasing and repaying.

Cashplus Bank Credit Card Eligibility

Currnetly, the Cashplus Bank Credit Card is not open for spontaneous applications. The Cashplus Bank sends emails or invitation letters to its customers who can apply for the Cashplus Bank Credit Card.

Generally, those who can apply for the credit card must be of legal age and have a stable income source. It is open for those who struggled with credit in the past, but they are still subjected to review.

I liked that the Cashplus Bank is open for those with a relatively low credit score or rating. It gives them a chance to improve their credit rating using the Cashplus Bank Credit Card.

Cashplus Bank Credit Card Application

As part of its innovative banking experience for its customers, Cashplus Bank only allows credit card applications online. It must be done through the official website or the mobile banking app of Cashplus Bank.

I just used the 10-digit reference number from my invitation letter to apply. Then, I have to enter my birthdate to access my personalized application form. Since the bank has access to my information already, I can get an instant decision if my application is approved or not.

However, the bank clarified that the approval still depends on the following factors: credit history and financial circumstances.

Cashplus Bank Mobile App

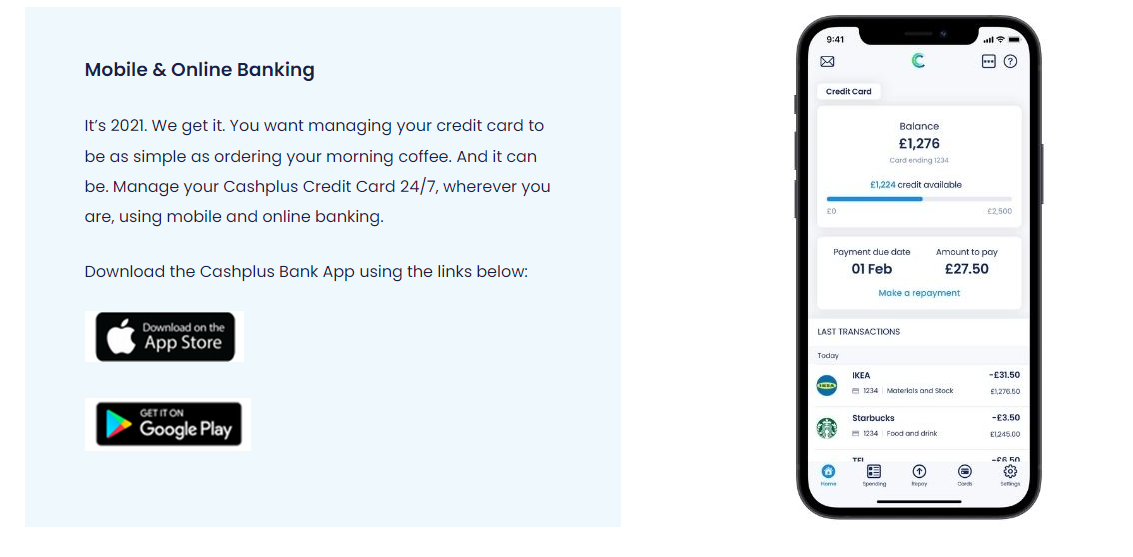

Another proof of its innovative service, Cashplus Bank has its mobile banking application.

All my Cashplus Bank accounts can be managed through the app, including my credit card account. The Cashplus Bank mobile bank is available 24/7. Plus, I can track all my transactions on my credit card on the Cashplus Bank mobile bank app.

In addition, the Cashplus Bank mobile banking app lets me set my repayment options for the balance on my Cashplus Bank Credit Card. In addition, it is possible to repay manually through the mobile bank.

Cashplus Bank Address and Contact Number

Although most transactions of Cashplus Bank are done online, it is still advisable to visit any of its branches for questions and clarifications regarding the credit card application.

The Cashplus Bank is headquartered on the 6th Floor, London, One London Wall. There is also a UK Customer Service hotline, which can be reached on weekdays and Saturdays at 0330 024 0924.

Also read: Marbles Credit Card | See How to Apply and Benefits

Conclusion

Cashplus Bank offers a credit card that will help its customers to manage their finances easily. The Cashplus Bank Credit Card has flexible repayment options, no annual free, and comes with a user-friendly mobile banking experience.

Disclaimer: There are risks involved when using credit card products. Always be sure to read the bank’s terms and conditions page for more information.